arizona solar tax credit form

We will update this page with a new version of the form for 2023 as soon as it is made available by the Arizona government. We last updated Arizona Form 310 in March 2022 from the Arizona Department of Revenue.

Solar Tax Credit Details H R Block

The tax credit amount was 30 percent up to January 1 2020.

. Arizona Department of Revenue tax credit. Include Forms 301 and 310 with your tax return to claim this credit. Is It Cheaper To Have A Solar Powered House.

As of 2019 just over seven million people are living in the state. More about the Arizona Form 310 Tax Credit. Arizonas Solar Energy Credit is available to individual taxpayers who install a solar or wind energy device at the taxpayers Arizona residence.

Which Arizona tax form is used for solar energy tax credits. The cumulative credit for all solar energy devices installed at the same residence cannot exceed 1000. Note that you only.

Form 5695 calculates tax credits for a variety of qualified residential energy improvements including geothermal heat pumps solar panels solar water heating small wind turbines and fuel cells. 23 rows Tax Credits Forms. The cumulative credit for all solar energy devices installed at the same residence cannot exceed 1000.

25 of the gross system cost up to a maximum of 1000. This information is provided as general knowledge. This is 26 off the entire cost of the system including equipment labor and permitting.

Now you can file your return. If you are installing solar yourself you dont need such a certificate but your solar energy device must meet the required criteria. Phoenix AZHomeowners who installed a solar energy device in their residential home during 2021 are advised to submit Form 310 Credit for Solar Energy Devices with their individual income tax return and Form 301 Nonrefundable Individual Tax Credits and Recapture.

Equipment and property tax exemptions. Online 2. Please check this page regularly as we will post the updated form as soon as it is released by the Arizona Department of Revenue.

The federal solar tax credit gives you a dollar-for-dollar reduction against your federal income tax. This credit can give you a reimbursement of up to 25 of the cost of your solar panels so you can spend less and get the installation you want. 552-4966 or fill out the following form for more info.

Note the Delete Form button at the bottom of the screen. Residential Arizona solar tax credit. Arizona has the Arizona Solar Tax Credit.

The Consolidated Appropriations Act of 2021 bill extended the 26 investment tax credit through 2022. In addition to Arizonas solar incentives youll be eligible for the federal solar tax credit if you buy your own home solar system outright. If you install your photovoltaic system in 2020 the federal tax credit is 26 of the cost of your solar panel system.

Thanks to the Solar Equipment Sales Tax Exemption you are free from the burden of any Arizona solar tax. Arizona Form 310 Credit for Solar Energy Devices 2020 Part 1 Current Years Credit NOTE. Summary of solar rebates in Arizona.

The Arizona tax credit for solar panels is 25 of your systems installed costs. This means that the. Starting in 2020 the value of the tax credit will step.

This form is for income earned in tax year 2021 with tax returns due in April 2022. This is claimed on Arizona Form 310 Credit for Solar Energy Devices. 1 Address of residence where you installed the solar.

1 Address of residence where you installed the solar energy device for which you are claiming the credit. You can only claim up to 1000 per calendar year on your state taxes. Go to View at the top choose Forms and select the desired form Arizona 310.

Additionally the states Department of Revenue can only approve up to 20 million a year for solar tax credits in Arizona. If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200. IRS Form 5695 for 2019.

A solar energy device is a system or series of mechanisms which collect and transfer solar. Here are the specifics. The federal tax credit falls to 22 at the end of 2022.

Arizona Solar Tax Credit Property Tax Exemptions. We last updated the Solar Liquid Fuel Credit in May 2021 and the latest form we have available is for tax year 2017. PEP SOLAR 2025 W Deer Valley Rd Suite 104 Phoenix AZ 85027.

Add the 1000 Arizona tax credit and you get a total deduction of 4393. Your solar installer needs to provide a certificate stating that the solar energy device complies with Arizonas solar energy device requirements. The 26 federal tax credit is equivalent to 3393.

Your Name as shown on Form 140 140PY or 140X Your Social Security Number Spouses Name as shown on Form 140 140PY or 140X if a joint return Spouses Social Security Number Part 1 Current Years Credit NOTE. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system. This means that we dont yet have the updated form for the current tax year.

The credit is allowed against the taxpayers personal income tax in the amount of 25 of the cost of a solar or wind energy device with a 1000 maximum allowable limit regardless of the number of energy devices installed. Delete form Arizona 310. The maximum credit in a taxable year cant be more than 1000 regardless of the number of solar energy devices installed in the same home.

The renewable technologies eligible are Photovoltaics Solar Water Heating other Solar Electric Technologies Wind Fuel Cells Geothermal and Heat Pumps. Enter your energy efficiency property costs. However there is also a specific Arizona solar tax credit that can be combined with the nationwide benefit and it gets deducted from your state income taxes.

To claim this credit you must also complete Arizona Form 301 Nonrefundable Individual Tax Credits and Recapture and. If you have any further questions regarding taxes consult a tax professional. The state sales tax of 56 does not apply to solar equipment.

The 30 tax credit applies as long as the home solar system is installed by December 31 2019. Buy new solar panels in Arizona and get a 25 credit of its total cost against your personal income taxes owed in that year. However unlike the federal governments tax credit incentive Arizona tax credits have a limit.

That can help you protect the planet and you wont need to pay as much to get started. Go to Tax Tools on the left and navigate to Tools-Delete a form. Residential Arizona Solar Tax Credit.

This credit comes off of your taxes in the year you install your system. It is a 25 tax credit on product and installation for both 2020 through 2023. Worth 26 of the gross system cost through 2020.

Well use 25000 gross cost of a solar energy system as an example. Neither Solar Concepts Redilight QuietCool or any product manufacturers are tax consultants.

Pricing Incentives Guide To Solar Panels In Arizona 2022 Forbes Home

Free Solar Panels Arizona What S The Catch How To Get

Everything You Need To Know About The Solar Tax Credit Palmetto

Arizona Solar Everything You Need To Know Understand Solar

Sample Construction Contract Check More At Https Nationalgriefawarenessday Com 26825 Sample Construction Con Construction Contract Contract Contract Template

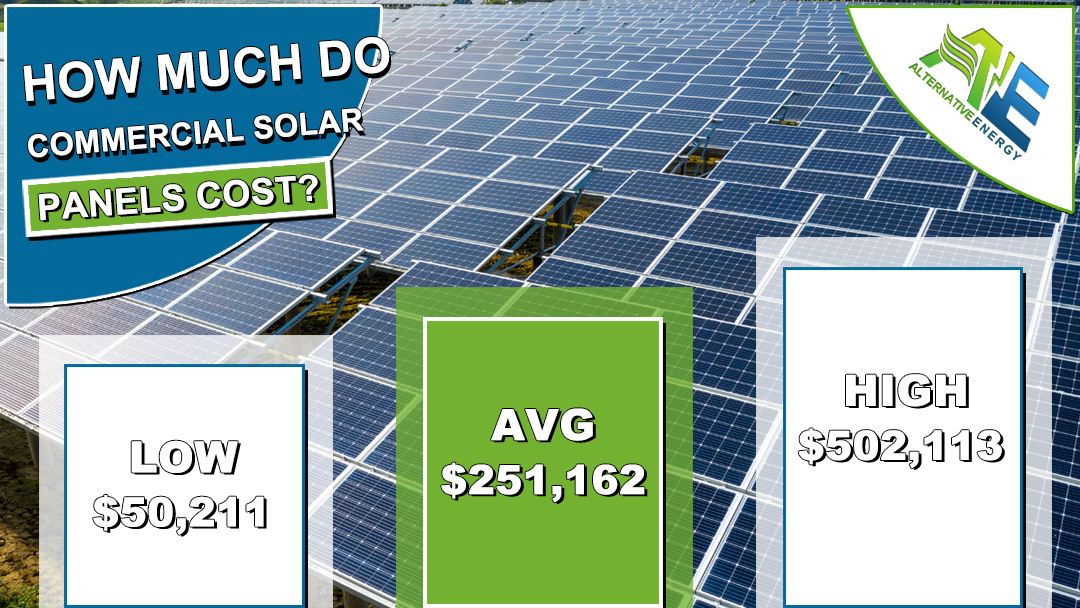

Commercial Solar Panels Cost 2021 Average Prices

Image Credit Copyright Adam Block Mount Lemmon Skycenter University Of Arizona Http Skycenter Arizona Edu Gallery Galaxie Spiral Galaxy Galaxy Art Galaxy

2022 Arizona Solar Incentives Guide Tax Credits Rebates More

2022 Arizona Solar Incentives Guide Tax Credits Rebates More

Federal Solar Tax Credit A Homeowner S Guide 2022 Updated

Solar Tax Credit In 2021 Southface Solar Electric Az

2022 Arizona Solar Incentives Guide Tax Credits Rebates More

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

Salmonella Poses A Triple Threat Ranging From Food Poisoning To Lethal Infection Salmonella Food Poisoning Triple Threat

Back To Back Sun Storms May Supercharge Earth S Northern Lights Space And Astronomy Earth And Space Science Astronomy